40+ 15 year conventional mortgage calculator

71 Arm Mortgage Rates. If you instead opt for a 15-year mortgage youll pay over the life of your loan or about 46 of the interest youd pay on a 30-year mortgage.

Pin On Money Things

Current Mortgage and Refinance Rates.

. An ARM has a fixed rate for a set time for example five seven or 10 years and then adjusts periodically for the remaining. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 2515 monthly payment. Related Mortgage Calculator Refinance Calculator Mortgage Payoff Calculator.

Assuming you have a 20 down payment 140000 your total mortgage on a 700000 home would be 560000. A reverse mortgage is a mortgage loan. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms.

On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan. One of the more conventional approaches financial advisors and experts suggest is the 6040 portfolio. 2008 the annual volume of HECM loans topped 112000 representing a 1300 increase in six years.

Use our mortgage calculator to estimate your monthly house payment including principal and interest property taxes and insurance. A fixed-rate mortgage FRM is a mortgage loan where the interest rate on the note remains the same through the term of the loan as opposed to loans where the interest rate may adjust or float. You can obtain them from private lenders such as banks credit.

Scotiabank Mortgage Calculator Mortgage details. Find average jumbo mortgage rates for the 30 year fixed rate mortgage from Mortgage News Daily. As a result payment amounts and the duration of the loan are fixed and the person who is responsible for paying back the loan benefits from a consistent single payment and the ability.

A 40-year mortgage with a variable rate Borrowers can get an adjustable-rate mortgage ARM with a 40-year term. A 6040 mix of stocks and bonds is a classic asset allocation but does it make sense for your portfolio. Thats about two-thirds of what you borrowed in interest.

CalHFA has loan programs such the first mortgage conventional or CalPLUS fixed-rate loan down payment assistance programs and mortgage. Dont forget to include your spouses age even if they are not yet 62 as loan proceeds are always based on the age of the youngest spouse. The following table lists historical average annual mortgage rates for conforming 30-year mortgages.

Estimate the cost of 30 year fixed and 15 year fixed mortgages. Simple Mortgage Calculator. 15 Year Fixed 30 Year FHA 30 Year Jumbo 51 ARM.

Download our FREE Reverse Mortgage Amortization Calculator and edit future appreciation rates interest rates and even future withdrawals. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. I will automatically calculate you a year older.

In the US conventional FHA and other mortgage lenders like to use two ratios called the front-end and back-end ratios to determine how much money they are willing to loan. For the fiscal year ending September 2011 loan volume had contracted in the wake of the financial crisis but remained at over 73000 loans that were originated and insured through the HECM program. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1796 monthly payment.

A 40-year mortgage extends the mortgage term by 10 years when compared with a traditional 30-year mortgage. These types of mortgage are not federally backed by the government. The average 15-year fixed mortgage rate is 5200 with an APR of 5230.

51 Arm Mortgage Rates. Historical 30-YR Mortgage Rates. This calculator defaults to a 15-year loan term and figures monthly mortgage payments based on the principal amount borrowed the length of the loan and the annual interest rate.

Your total interest on a 250000 mortgage. Depending on the mortgage solution that you select each year you can increase your scheduled monthly payments by up to 10 15 or 20 of the payment initially set for your term or in some cases your current payment and make a lump sum prepayment of up to 10 15 or 20 of your original. Most people need a mortgage to finance a home purchase.

You can use the following calculators to compare 10 year mortgages side-by-side against 15-year 20-year and 30-year options. Few homes are built to last 100 years. In 2016 the average mortgage term in Sweeden was reported to be 140 years before regulators set a cap at 105 years.

The average 51 adjustable-rate mortgage ARM rate is 4460 with an APR of 6220. In 2016 and 2017 many younger borrowers across the UK have moved away from using their once-standard 25-year mortgage toward 30 35 even 40-year loan options. Going this route can make portfolio.

10-year mortgages tend to be priced at roughly 05 to 10 lower than 30-year mortgages. Assuming you have a 20 down payment 100000 your total mortgage on a 500000 home would be 400000. They are basic debt-to-income ratios DTI albeit slightly different and explained below.

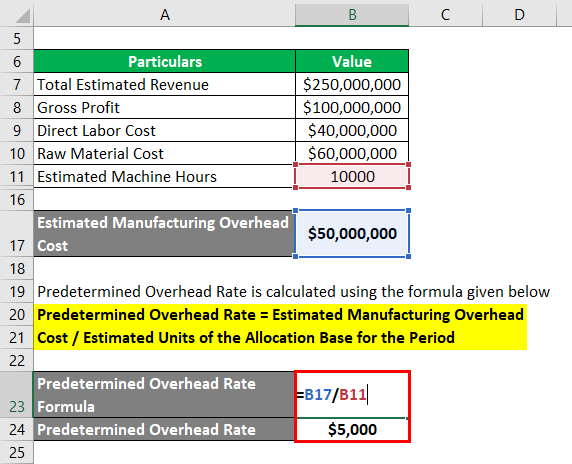

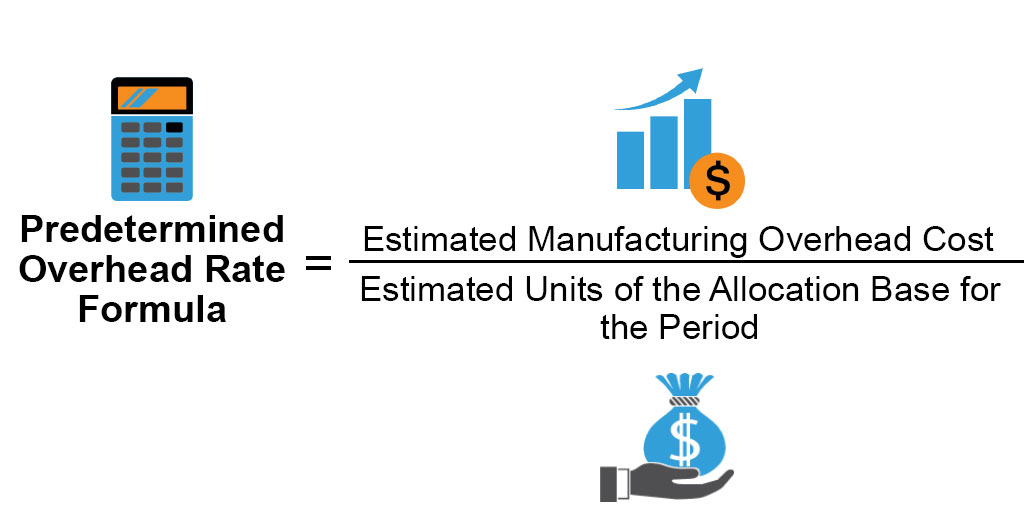

Predetermined Overhead Rate Formula Calculator With Excel Template

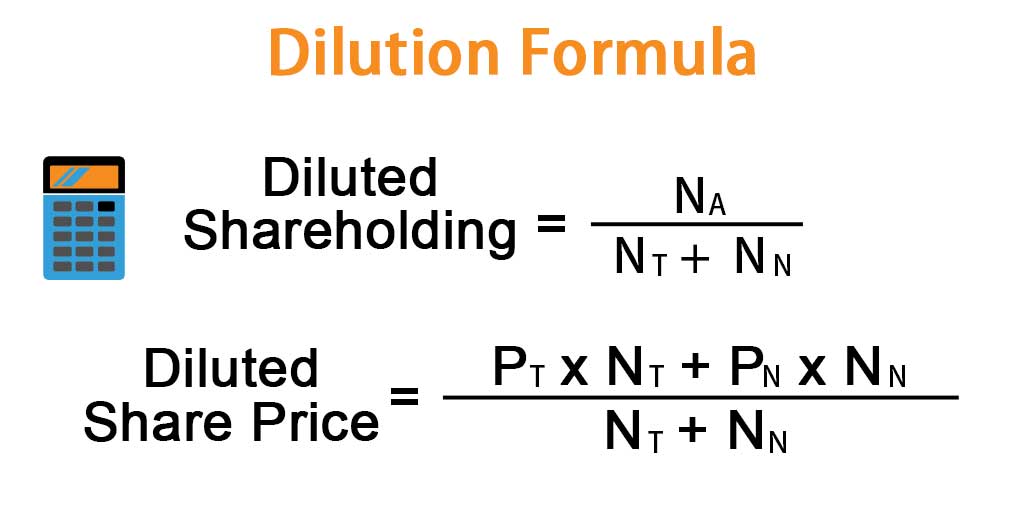

Dilution Formula Calculator Examples With Excel Template

40 Financial Calculators Ease Your Decision Making

The Ignorance Of People 40 Today You Can T Even Have A Conversation Without Them Gaslighting You Into Thinking The Market Is Affordable For Young People R Canadahousing

Ssjtafrpq7xz M

Etsy Fee Profit Calculator Spreadsheet Etsy Fees For 40 Etsy Uk

Payroll Calculator Template Free Payroll Template Payroll Business Template

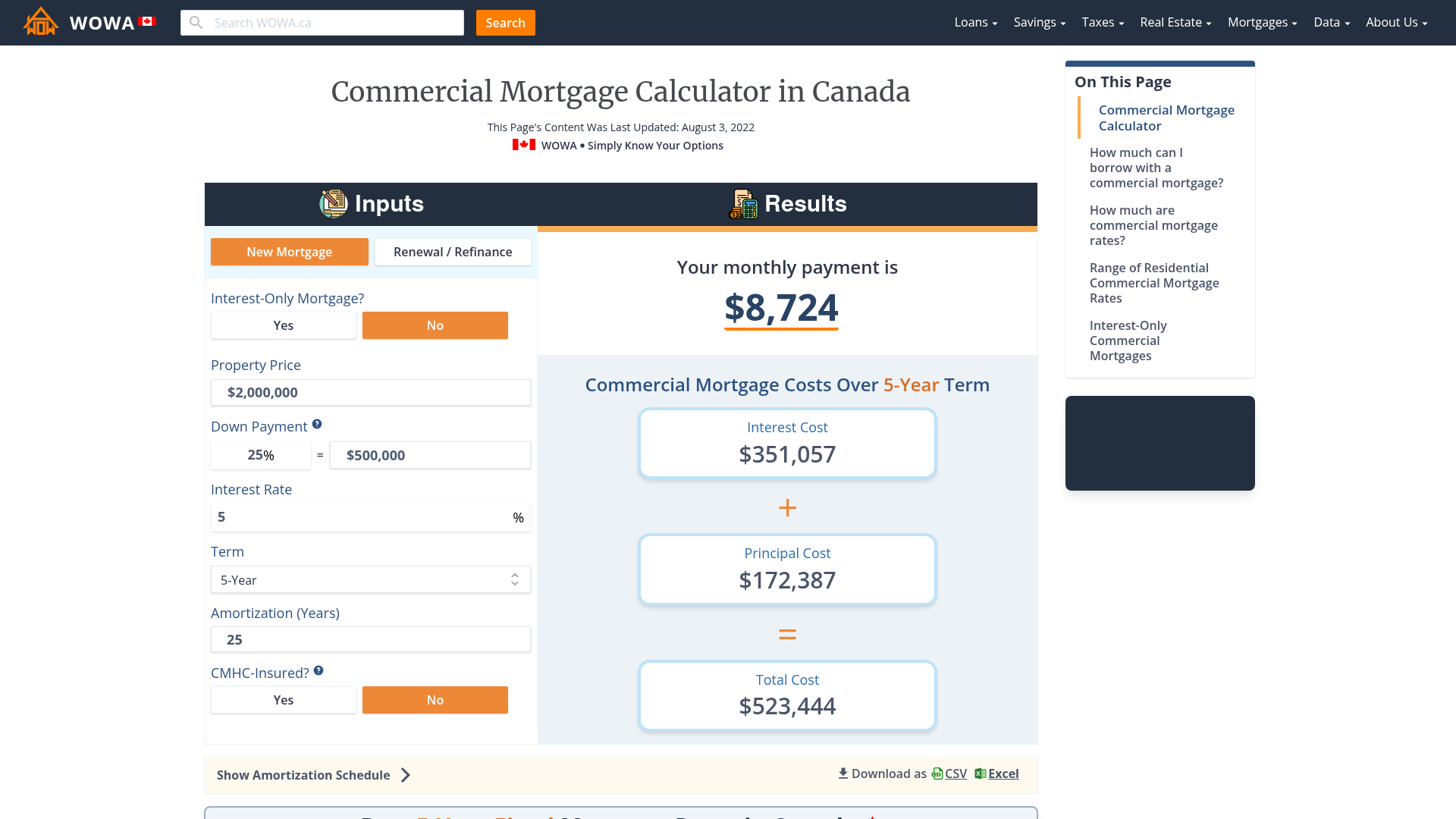

Commercial Mortgage Calculator Payment Amortization

Predetermined Overhead Rate Formula Calculator With Excel Template

How To Use A Mortgage Calculator Comparewise

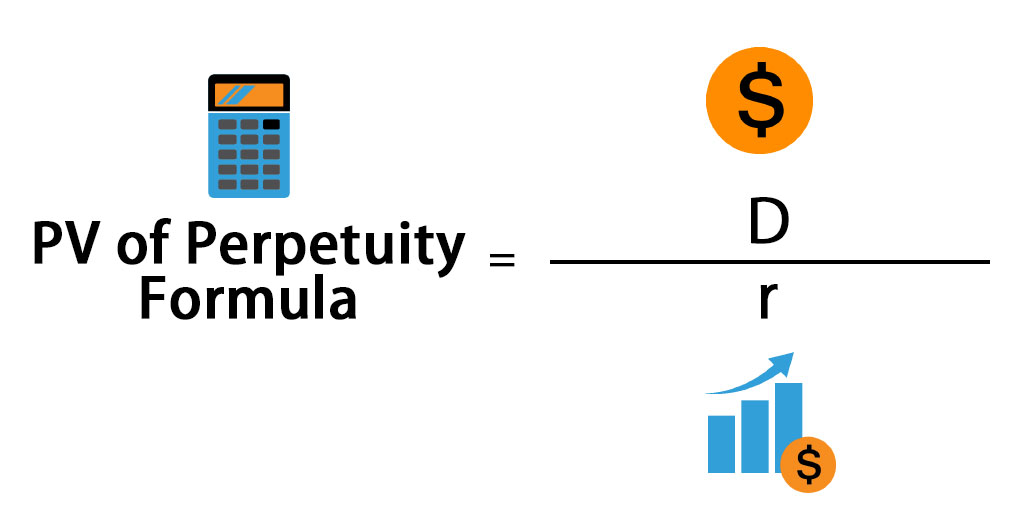

Perpetuity Formula Calculator With Excel Template

20 Beautiful Small Bathroom Ideas Small Full Bathroom Bathroom Layout Small Bathroom With Shower

Impressive Master Bedroom Design In Dubai From Luxury Antonovich Design

Canada Mortgage Refinance Calculator 2022 Wowa Ca

Reserve Ratio Formula Calculator Example With Excel Template

Mortgage Down Payment Calculator 2022 Mortgage Rules Wowa Ca

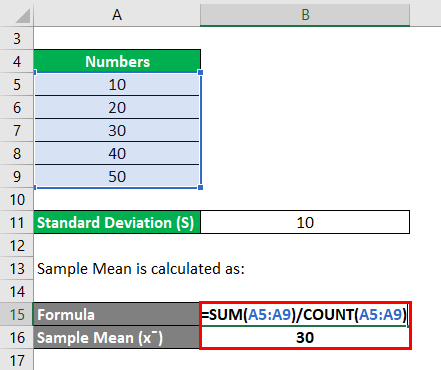

Relative Standard Deviation Formula Rsd Calculator Excel Template